At the beginning of 2015, the retail market learned the existence of machine made diamonds in detail. Not that no one had ever heard of it before, but the subject has suddenly become very hot. At JCK Las Vegas that year, most retailers spoke out against synthetics, stating that they did not want to be associated with them. However, only a year later, retailers, merchants and most other professionals were singing a different song: “We’ll go where our customers are waiting for us.” And indeed, the consumer market is the one that sets the pace.

Further study reveals some of the factors that played a role in this shift in attitude toward machine made diamonds. For example, retail margins on machine made diamonds were higher. The traders understood it too. If we add the growing consumer demand for a cheaper product that promises to be identical (and more ethical, as claimed by false claims), it did not take long before the floodgates opened.

Beyond the first adopters

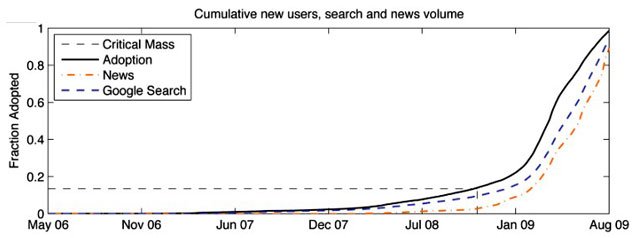

Currently, we are at a traditional point of evolution, which has seen many products: after a long period of very slow development and a sluggish pace of adoption, followed by rising demand and diffusion of information by early adopters, we are now at the stage of the giant leap, during which the market adopts the product. This model worked for Google searches, smartphone purchases and the number of new users on Twitter. The following graph shows the Twitter model, taken from Plos One (a highly recommended read if you want to understand the modeling of these trends).

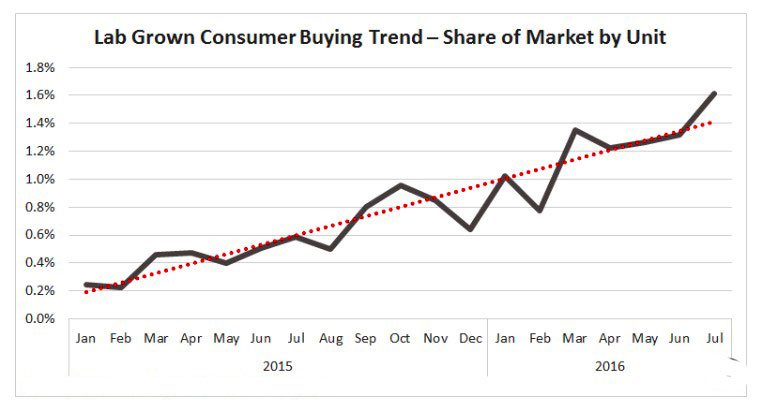

This trend represents the reality of machine made diamonds in the consumer market. And to prove it, study the following graph of machine made diamonds sales since 2015. The numbers were weak at the time but the first trend was obvious: in 18 months, machine made diamonds sales, as a percentage of all diamond sales, have not just doubled or quadrupled, they have been multiplied by eight.

The jump in the pace of adoption is not limited to consumers or retailers. Traders, manufacturers and other players in the diamond industry are also entering the machine made diamonds sector.

What happened to the prices?

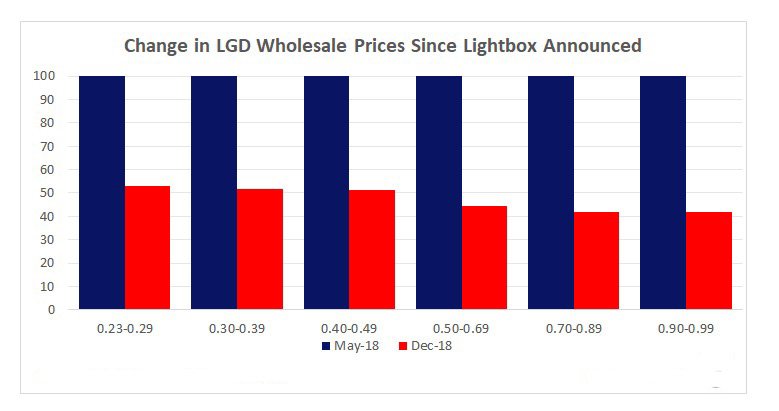

In an attempt to protect diamonds from a loss of market share, De Beers launched a new Lightbox initiative in May 2018. One of the program’s motives was to price machine made diamonds based on a reasonable margin, beyond the costs of production, and not on the basis of a kind of artificial gap with natural diamond tariffs.

The industry has considered Lightbox’s tariffs at $ 800 per carat as a possible factor in lowering the price of machine made diamonds and, as a result, their positioning in the eyes of consumers, who then become a mere article of imitation or replacement. Did Lightbox manage to force this price drop? The answer is mixed.

In August 2018, almost three months after the announcement of Lightbox and just before the start of sales, interviews of producers and traders of machine made diamonds, as well as jewelry manufacturers about the pricing, found them all almost unanimous: wholesale transaction prices had dropped by about 30% to 40%.

Prices were fairly stable in September, while the machine made diamonds market had already taken into account the new prices and the hesitation expressed by US retailers before the next launch of Lightbox.

Smalls continue to retreat

In the following months, something interesting happened. Prices for machine made diamonds rounds of 1 carat and over remained stable. Everything below, where Lightbox was present, continued to see prices drop. A trend emerged: the smaller the goods, the less they lost. By the end of December 2018, carat prices had dropped an additional 12% and machine made diamonds rounds from 0.90 to 0.99 carats had lost more than 30% on average.

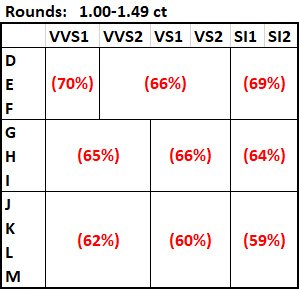

As shown in the map below, the price changes are not the same for all color and purity combinations. One of the tariff trends shows very limited declines in lower-grade and higher-purity goods, as opposed to a sharp decline in the prices of goods of lower color and purity, such as for quarter-carat.

Price of machine made diamonds and natural diamonds

The market is often wondering about the difference between the prices of natural diamonds and machine made diamonds. This question usually concerns retail prices. A quick comparison of retail prices shows a difference of between 20% and 40%, depending on the goods, the retail branding, the market positioning, etc. Wholesale prices show very different behaviors. In this market, diamonds have the same prices as a commodity, a much more accurate way of measuring price changes over time.

Machine made diamonds cut wholesale prices are 50% to 85% lower than natural diamonds. The magnitude of the price gap has two general characteristics. First, the smaller the goods, the larger the price gap. Secondly, the price difference between machine made diamonds and natural diamonds with a good combination of colors and purities (DEF / VVS) is greater than between goods with a lower color / quality combination (KLM / SI2-I).

On average, at the end of December, machine made diamonds of 1 carat were priced 64% less than natural diamonds. Carat thirds were 75% cheaper. If you’re wondering why the retail price gap is so small, the answer is simple: retailers are taking a bigger margin.

Conclusion

The demand for machine made diamonds is increasing. Retailers of all segments, except the very high-end, entered the market. When Lightbox set up competition, prices went down. Everything is not due to Lightbox but it shows that when the industry fights, it can win. Currently, retailers are enjoying better margins on machine made diamonds, which encourages them to continue promoting to customers.

If diamond companies want to preserve their market, they have to wake up now and move on, otherwise they could quickly disappear. The economic reasoning is simple: most diamond mines produce a series of goods, ranging from very small, low quality stones to greater-sized marvels. Since the mines have to sell the whole range in order for their operations to be profitable, they will refrain from extracting if they are not able to sell the low and mid-range goods. Without basic goods, almost nothing else can be extracted or proposed.

In short, if the first graph terrifies you, you understand that the industry must set out and fight for its future success.

“What is difficult is good, easy does not generate lasting profit.”

Sylvain Goldberg