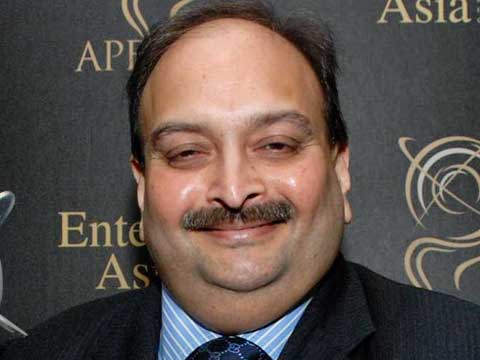

Image: Hindustan Times

Gitanjali Gems, whose chairman is a suspect in India’s largest bank fraud, is expected to go into liquidation, after its lenders rejected a recovery plan.

Creditors voted by a 54% majority on March 28 not to extend Gitanjali’s “corporate-insolvency resolution process,” a six-month window during which a company’s ability to repay its debts is assessed. That process therefore lapsed on April 6, according to a filing with the Bombay Stock Exchange earlier this week.

“Since [the] extension is not approved by the [committee of creditors], the next logical step in the corporate-insolvency resolution process would be to go for liquidation of the company,” said Vijay Kumar Garg, who acts as the Indian jeweler’s resolution professional.

Gitanjali’s founder, Mehul Choksi, is on the run, after India’s Punjab National Bank (PNB) alleged that he and his nephew, Nirav Modi, had defrauded it of $2 billion. Choksi is thought to be in Antigua and Barbuda, while police arrested Modi in London last month. The accusations first came to light in January 2018.

Gitanjali owes a total of INR 125.58 billion ($1.81 billion) to 31 banks and other financial institutions, according to another filing by the company. PNB, the largest creditor, claims to be owed INR 55.19 billion ($795.6 million), and was entitled to 44% of the vote.

About the Gitanjali Group

Gitanjali Group was one of the largest branded jewellery retailers in the world. It is headquartered in Mumbai, India. Gitanjali sells its jewellery through over 4,000 Points of Sale and enjoys a market share of over 50 per cent of the overall organized jewelry market in India.

Founded as a single company cutting and polishing diamonds for the jewellery trade at Surat, Gujarat, in 1966, the Gitanjali Group became, many times over, a pioneer among major diamond and jewellery houses.

First major diamond and jewellery house to be launched and run by modern entrepreneurs rather than dynastic jewelers. An authorised DTC Sightholder and loyal customer – and a modern multinational business run on innovative insights.

At the forefront of the global breakthrough in diamond jewellery design and production brought about by India’s ability to cut diamonds considered unworkable for jewellery till then. Has the distinction of producing the world’s smallest heart shaped diamond (0.03 carat), and developing some 25 patented facet patterns.

Besides changing the face of manufacture, broke the mould of traditional jewellery marketing: it abandoned jewellery trade convention by launching multiple brands for multiple markets and price segments.