The Lightbox synthetic brand is now a reality. Steve Coe, its managing director, discusses the prospects of the project.

In May, De Beers shook the industry by announcing the upcoming launch of a line of fashion jewelry featuring synthetic diamonds. Lightbox Jewelry started selling its products on the Internet in September and is now exploring new options for growth.

The main opportunity to develop the business will come when De Beers has completed the construction of a $ 94 million manufacturing facility in Oregon in 2020. This facility will produce close to 500,000 carats of rough each year, providing Lightbox with most of his offer. Diamonds will be added to the current production from its Ascot facility in the United Kingdom.

For now, the company only sells its jewelry on its own website but plans to enter into partnerships with retailers to sell on the Internet and in stores.

Partners

According to Steve Coe, Managing Director of Lightbox, several retailers have already expressed interest in the product.

“We have had preliminary discussions with some, but as we have made it clear from the start, the first step will be to sell the product through e-commerce,” he says. “We would like to be able to integrate a few retailers in 2019. To be honest, the operation will be quite limited this year because we will have to wait until our new manufacturing plant in Portland, Oregon, enters service in 2020. We will then have a really big volume that will allow us to deploy a broader base of retailers.”

Lightbox will likely partner with less than 10 retailers in 2019, although these companies may have several stores each, he continues. In the long term, the jewelry should be offered to retailers, be they independents with only one shop or national chains.

Lightbox will initially target the US market since it is the largest pool of consumers. The brand could expand further when supply increases after 2020, says Steve Coe.

More colors

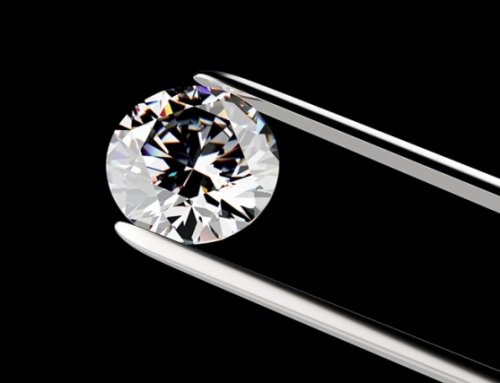

It could also expand the range of colors proposed, he adds. Lightbox currently focuses on white, pink and blue synthetics up to 1 carat and puts forward its own research showing that consumers judge synthetic diamonds as a rather pleasant everyday product, and not a jewel they would buy to mark the major stages of life. That’s why they offer colorful, relatively cheap fashion jewelry at $ 800 per carat, instead of targeting the bridal market. Including setting, none of these products will exceed $ 1,000 at retail.

“I imagine that two to three years from now, we will develop different shades of pink and blue,” says Steve Coe. “We could lighten or darken the current colors, but also test others. Yellow seems a pretty obvious choice but we could also opt for light green or purple. We could really try several colors and the scientists at Element Six “Not all colors are as easy to create. Lightbox employees have already shown they can produce different shades of pink and blue, as well as purples and light greens,” says Steve Coe. “Red is more complicated to get,” he says. It is therefore unlikely that Lightbox offers red for now. The first products offered by Lightbox are earrings and necklaces with simple and classic design. “So far, the feedback has been very positive,” says Steve Coe. But this is only the beginning. We have many opportunities to develop more interesting designs in the future. “The company is working with its independent designers on new designs incorporating its current range of sizes and colors. These products are expected to hit the market soon,” he adds. Other designs will be produced in 2019. Lightbox recently confirmed that it will soon be offering bracelets and stackable rings. Natural diamonds still forever Some traders are concerned that De Beers’ arrival in the synthetics segment will hurt the demand for rough and natural diamonds in lower value categories. However, Steve Coe considers that the business opportunities that are created are greater than the apparent risk that consumers replace, at the same price, natural stones with synthetic diamonds. “We really think of Lightbox as an extra opportunity,” says Steve Coe. “Color plays a very important role in the product line (pink and blue stones). So it’s very different from natural diamonds. In addition, these diamonds seem more suitable for gifts without special occasions, personal purchases or for young teenage girls. There is very little overlap with traditional natural diamonds.” The impact of Lightbox on the market as a whole will be minimal for another simple reason: its annual output is tiny compared to more than 100 million carats of natural rough that come out of the ground each year, he says. Competitor By marketing synthetics as a pleasant and affordable product, De Beers takes a different approach than other market players who often present synthetics as a cheap alternative to bridal jewelry. Lightbox’s strategy reflects what consumers have said to De Beers researchers, according to Steve Coe: diamonds from a machine look great but are not suitable for engagement rings. “All we are trying to do is offer a product that exactly meets the demands of consumers,” he says. “This seems a good way to explore, to maximize our chances of commercial success. What other synthetic suppliers do is their choice. In my opinion, they miss an opportunity, to enter the fashion jewelry segment. But that’s not our problem.“ “Luxury, in my opinion, is however rarity, creativity, elegance and not the mass production of synthetic products.” Sylvain Goldberg